Latest Quarterly Result

Quarterly Report For The Financial Period Ended 31 December 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

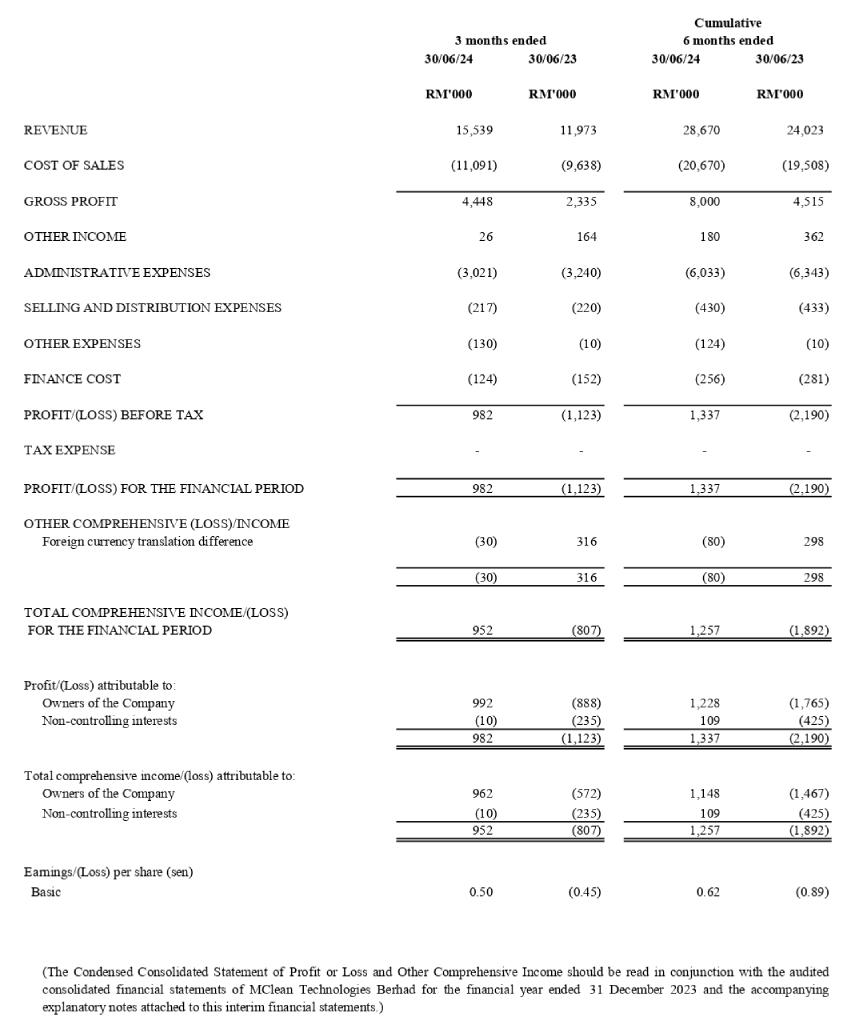

Condensed Consolidated Statement Of Profit Or Loss And Other Comprehensive Income For The Quarter And Twelve Months Ended 31 December 2024

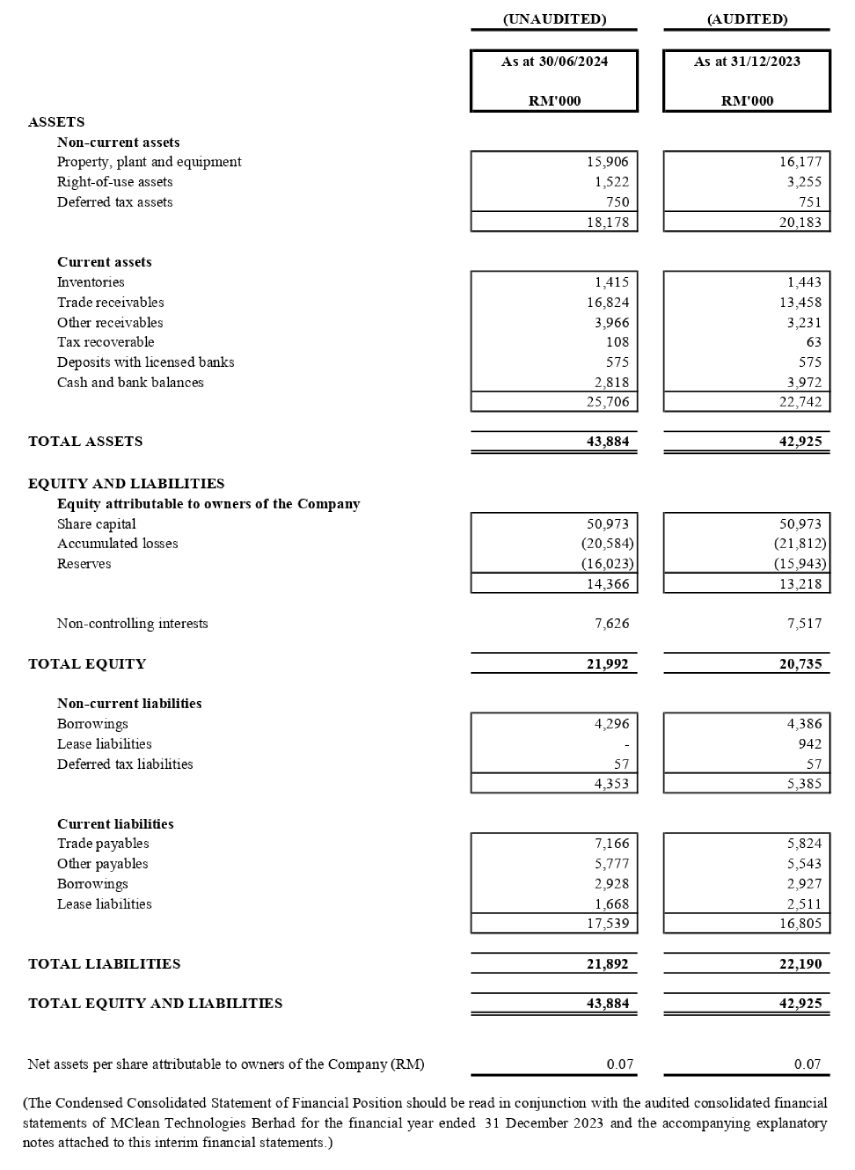

Condensed Consolidated Statement Of Financial Position

As At 31 December 2024

Review of Performance

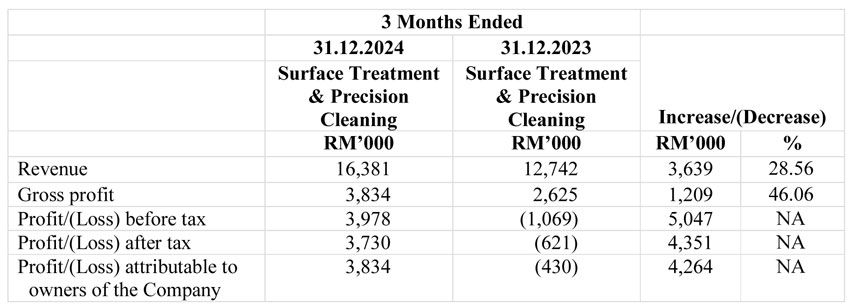

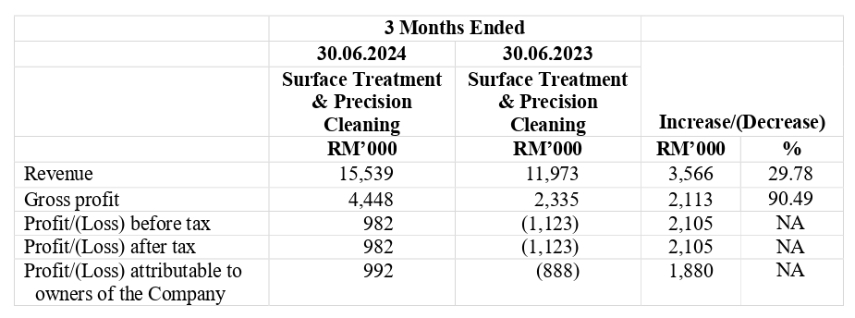

Comparison between Financial Quarter Ended 31 December 2024 ("4Q2024") and Previous Corresponding Quarter Ended 31 December 2023 ("4Q2023")

A summary of the Group's performance is set out below:-

Revenue increased by 28.56% from RM12.7 million in 4Q2023 to RM16.4 million in 4Q2024 due mainly to the increase in revenue from both precision cleaning and surface treatment activities.

Gross profit margin increased from 20.60% in 4Q2023 to 23.41% in 4Q2024 due mainly to an overall improvement in operating efficiency of both precision cleaning and surface treatment activities.

Other income increased by RM4.2 million in 4Q2024 as compared with 4Q2023 due mainly to the reversal of impairment loss on property, plant and equipment ("PPE") in our Thailand operation in 4Q2024.

Administrative expenses increased by RM1.0 million in 4Q2024 as compared with 4Q2023 due mainly to corporate exercise expenses incurred in 4Q2024.

Other expenses decreased by RM0.7 million in 4Q2024 as compared with 4Q2023 due mainly to the decrease in loss on foreign exchange in 4Q2024.

Overall, the Group reported a profit before tax of RM4.0 million in 4Q2024 as compared with a loss before tax of RM1.0 million in 4Q2023.

Comparison between Current Year-to-date Ended 31 December 2024 ("12M2024") and Previous Corresponding Year-to-date Ended 31 December 2023 ("12M2023")

A summary of the Group's performance is set out below:-

Revenue increased by 28.19% from RM47.8 million in 12M2023 to RM61.3 million in 12M2024, due mainly to increase in revenue from both precision cleaning and surface treatment activities.

Gross profit margin increased from 19.94% in 12M2023 to 27.82% in 12M2024 due mainly to an overall improvement in operating efficiency from both precision cleaning and surface treatment activities.

Other income increased by RM4.0 million in 12M2024 as compared with 12M2023 due mainly to the reversal of impairment loss on PPE in our Thailand operation in 4Q2024.

Other expenses decreased by RM0.2 million in 12M2024 as compared with 12M2023 due mainly to the decrease in loss on foreign exchange in 12M2024.

Overall, the Group reported a profit before tax of RM6.4 million in 12M2024 as compared with a loss before tax of RM5.3 million in 12M2023.

Future Prospects

With the improved balance sheet from the completion of the Proposed Private Placement, the immediate focus of the Company is to complete the Proposed Acquisition and focus on integrating the new plastic injection moulding business with the rest of the Group's business while ensuring minimal disruption to businesses during such transition period. As announced previously, the Proposed Acquisition is a strategic move by the Group to enhance and diversify its revenue streams, with the intention of achieving operational synergies and to present a one stop solution to its customers, particularly in high demand industries such as E&E and automotive industries.

The Group also intends to continue exploring value-adding opportunities, including both organic and inorganic growth opportunities, as well as to continue to utilise our capital efficiently.

In terms of market outlook, we remain cautiously optimistic on the market outlook for 2025 aims to achieve stable growth for FY2025 results amidst the various initiatives mentioned above.